Tech-savvy scammers taking from the federal government’s Covid pandemic relief programs to assist companies have actually discovered a practical method to wash the cash: they’re opening accounts with a minimum of 4 online financial investment platforms, police authorities stated.

The digital platforms, private investigators stated, are simple to dispose the cash into by establishing accounts with taken identities. More than $100 million in deceitful funds gone through financial investment accounts because Congress passed the CARES Act last March, according to authorities.

Burglars have actually utilized Robinhood, TD Ameritrade, E-Trade and Fidelity to wash the cash, a police source stated.

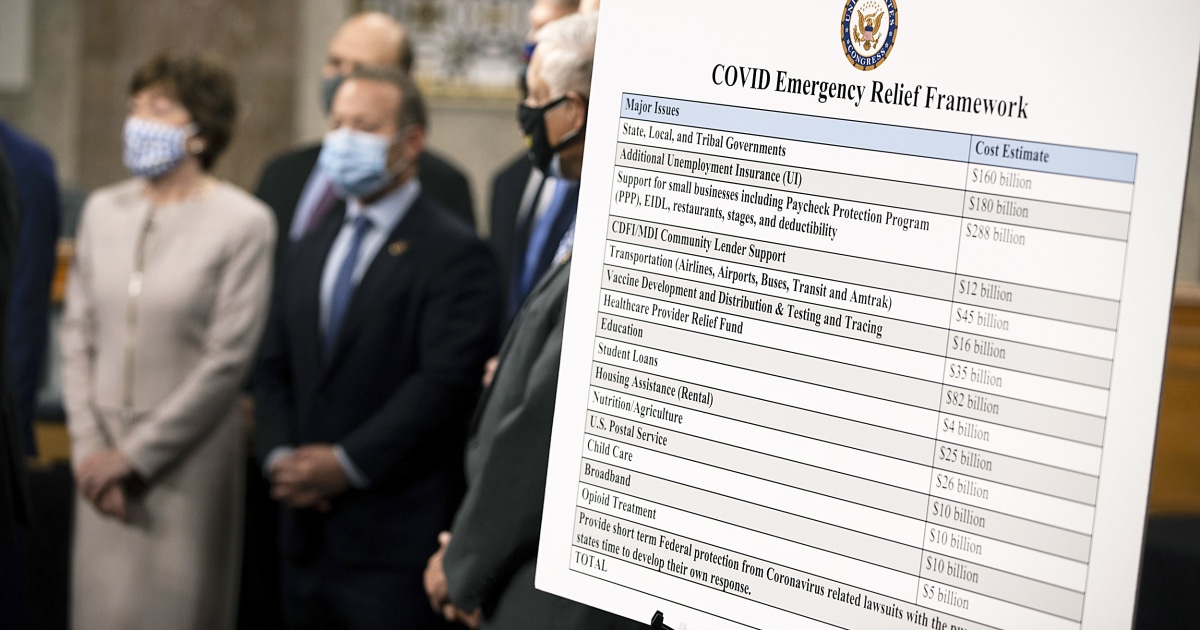

The federal government rapidly presented the Income Defense Program and the Economic Injury Catastrophe Loan, or EIDL, program in 2015 to assist small companies. Both programs have actually been afflicted with issues. An inspector general’s report provided last October blamed insufficient controls for billions of dollars in possible scams.

” The burglars are caring this things. This has actually been the monetary criminal activity treasure trove act of 2021,” stated Charles Intriago, a cash laundering specialist and previous federal district attorney.

Due to the size of the possible scams, he stated, police is dealing with “a leviathan circumstance where the cash is so enormous, and the wrongdoers are taking a look at it as a terrific chance. They’re drooling at the possibility to rip it off.”

Many examinations into the cash laundering are underway, according to Roy Dotson, Trick Service assistant unique representative in charge, who focuses on monetary criminal offenses.

” It’s certainly something that shows up to us. There’s all kinds of financial investment platforms being made use of doing this,” stated Dotson.

Wrongdoers are making the most of how simple it is to register for accounts, in addition to the relative privacy compared to opening a savings account, he stated.

” It’s simply another layer to make it harder for police to comprehend where the funds originated from,” he stated.

Dotson would not go over the names or variety of business targeted. He would just state that it’s “several financial investment platforms.”

He approximated that “more than $100 million has actually gone through these platforms” in this way.

How the scams works

The scams usually works like this: The criminal takes an entrepreneur’s identity and looks for a loan. Once they get the funds, the cash requires to be transferred someplace that makes it tough for private investigators to trace. Scammers consistently utilize the taken identity, which generally is somebody’s date of birth, Social Security number and other individual details, to open a financial investment account such as at Robinhood.

In other cases, police authorities stated, the lawbreakers utilize what’s called a “artificial identity,” which is a fictitious Social Security number connected to a genuine individual, or “mules” who are in on the plan.

Robinhood, which has actually remained in the news just recently since of a wave of retail financier interest created by so-called meme stocks such as GameStop, has actually been targeted in numerous scams cases under examination.

Ricardo Pena, a scams investigator with the Coral Springs Authorities Department in Florida who becomes part of a federal anti-fraud job force, stated he is examining numerous cases where Robinhood was utilized by lawbreakers to wash PPP funds and EIDL funds.

In one case, Pena stated the scammer took the identity of a regional citizen called Marc Heiberg and had the ability to get $28,000 in EIDL funds, which were gotten utilizing deceptive details for a nonexistent service with 60 workers. The scammer then opened a Robinhood account and tried to move the majority of the cash from a checking account utilizing the victim’s identity.

Records reveal an “ACH turnaround” 3 days after the account was opened, Pena stated. That indicates the transfer was reversed.

Heiberg, a business retailing supervisor, stated Robinhood informed him that it was checking out the deceitful account. The bad guys opened an account with Chase, also, he stated.

” It ends up being simply absolutely outrageous that they can simply take anybody out there like myself, take your Social Security number and open accounts through a bank, open accounts through the federal government and have actually that cash transferred and after that begin cash laundering, laundering it into other business,” Heiberg stated.

He stated he is fretted that other accounts may have been opened in his name.

” My name implies whatever to me. You understand, I have actually got, I have actually got young boys, I have actually got a household. And, you understand, I desire their names to be undamaged too,” Heiberg stated.

The Small Company Administration, which manages the loan programs, informed CNBC that “brand-new, boosted steps” to find scams have actually been put in location considering that the preliminary of loans were presented in 2015.

In a declaration, Chase Chief Communications Officer Amy Bonitatibus stated: “We actively keep an eye on for indications of scams and rapidly act to safeguard our consumers. In this case, we instantly determined suspicious activity on the account, which assisted avoid cash from being withdrawn or moved.”

Pena, the Coral Springs investigator, stated he has actually not determined who established the deceptive accounts, however screenshots of security video reveals a suspect attempting to take cash out of an ATM at the bank.

He stated Robinhood is frequently targeted due to the fact that of its appeal amongst more youthful individuals– and much of the bad guys remain in their 20 s.

” You find out about it; everyone goes to it. Even the bad guys understand about it,” Pena stated. “A great deal of individuals that are doing these scams are more youthful. They comprehend online banking. Platforms like Robinhood are simply much easier to get these accounts in order to press cash in and out. And they understand there’s not that much oversight.”

Rick McDonell, executive director of the Association of Licensed Anti-Money Laundering Specialists, stated he is not amazed by this type of scams.

” If I were a great crook, I would prevent banks like the pester,” stated McDonell, among the world’s leading specialists in cash laundering.

Scammers are likewise brought in to the ease of utilizing Robinhood and other such platforms, according to Etay Maor, senior director of security technique at Cato Networks.

” It’s not like you need to stroll into a bank and reveal yourself,” Maor stated. “The bad guys do their research and discover the very best method for high-reward and low-risk scenarios like that. By the time you learn the info, the cash is method gone.”

The platforms react

3 of the financial investment platforms that reacted to an ask for remark informed CNBC they have strong anti-fraud procedures in location to confirm account details, and have actually been dealing with police on this problem.

A Robinhood representative stated: “We are laser concentrated on avoiding scams prior to it takes place and our scams and security groups have actually been dealing with police to alleviate and resolve this industry-wide issue. Like other brokerages and banks, Robinhood validates brand-new consumer details throughout different information sources, and needs government-issued IDs as suitable.”

A representative for TD Ameritrade stated the business “made efforts from the start of the CARES Act to be at the leading edge of recognizing and alleviating this kind of deceptive activity, consisting of engaging with Police, Peer Firms and Federal government firms.”

It included that “there will constantly be bad stars who will attempt to benefit from susceptible investors/people at every chance they can– it’s precisely why we have procedures and controls in location in an effort to recognize and intensify this habits.”

Fidelity stated in a declaration that it has actually “discovered accounts with suspicious deposits related to this industry-wide problem connected to COVID-19 relief funds. We are participated in continuous coordination with police and their efforts in this regard.”

In addition, the business stated it has a “variety of safeguards and several layers of security in location for identifying deceitful accounts and subsequent deals. By style, a few of our defenses show up and some are not. To assist make sure the stability of our security practices, it’s not suitable for us to comment even more on those particular safeguards.”

E-Trade did not react to several e-mails and calls.

Other scams

Some scammers who utilize online financial investment platforms do not even trouble to take an identity.

In a current case in Seattle, district attorneys charged tech executive Mukund Mohan with getting an overall of $5.5 million in PPP funds by sending deceptive loan applications. Court filings reveal $231,471 was transferred in Mohan’s Robinhood account with the rest in numerous banks.

Mohan, whose LinkedIn account notes him as a previous director of engineering at Microsoft and item management director at Amazon, has actually excused the scams.

In a post from last August after he was charged in the case, Mohan composed: “I did mess up. Can’t state no. I injure individuals who trusted me, thought in me, and now are besides themselves. I can not talk about the information provided the legal scenarios, however I really ask forgiveness.”

Mohan pleaded guilty to wire scams and cash laundering, with sentencing set up for July. He decreased CNBC’s ask for remark.

The Trick Service’s Dotson stated the size of the total scams is incredible, an assertion supported by other federal companies and departments.

The Department of Justice has actually taken or surrendered $626 million in funds as an outcome of criminal and civil examinations linked to the PPP and EIDL programs, less than 1%of the almost $84 billion in scams recognized in the programs, according to your house Select Subcommittee on the Coronavirus Crisis.

” Since of the large volume of the stimulus bundle and the quantity of cash and the chances, that simply resulted in people utilizing all the various platforms,” Dotson stated.

No comments:

Post a Comment