I’m not sure anybody wants to hear more about Texas Senator Ted Cruz and his Cancún winter break. On the other hand, here’s what I have in On the Street: why President Biden’s COVID relief bundle has to be passed ASAP; the Texas catastrophe; a little on the Robinhood hearings; and even a link to an occasion hosted by famous investor, and Warren Buffett wingman, Charlie Munger.

Saul Loeb/AFP via Getty Images

Jeez, Just Pass the Relief Bill Already: Almost 1.4 million people obtained joblessness insurance advantages last week, including 861,000 who looked for basic state joblessness– and 516,000 more who applied under the program that covers, to name a few, gig workers. The Economic Policy Institute explains that the results were the 48 th successive week “claims were higher than the worst week of the fantastic economic downturn.” In addition, the existing enhanced unemployment benefits go out in mid-March. What’s the trouble on President Biden’s $1.9 trillion COVID relief plan? Right now, a lot of quibbling over the size of it. Some Democrats, and like-minded economists, seem like the $1,400 relief checks require to be targeted towards people who truly need them. I won’t argue with that. But I will argue that there’s no good case to be made to lower the proposed $350 billion payment to state and city governments, which have been hammered by COVID. Congressional Republicans would enjoy that. To be sure, the residents aren’t in the exact same alarming straits as they were months earlier. (See that argument set out by Charles Lane at The Washington Post) Okay, reasonable enough. The issue is you truly can’t target a figure properly, particularly since you do not understand, for example, what the impact of the brand-new COVID variations may or may not have on the economy. As Louise Sheiner, policy director at the Hutchins Center of Fiscal and Monetary Policy, stated throughout a Brookings webinar just recently, you “must be rather generous so you ensure you get the result you want.” She added: “Erring on the side of doing too much is something I would do.” The costs is anticipated to be in Biden’s hands by mid-March. During the arguments over the next few weeks, keep in mind the big lesson of the excellent recession: too little stimulus, per Senator Mitch McConnell, put a damper on the healing. The bottom line: pass the relief bill mainly as is, with or without McConnell along for the trip.

Getty Images

Lessons From the Huge Chill: If you want to know the reality, Texas can and will resolve some of the issues that afflicted it in the “Winter Storm of 2021.” They might follow suggestions that came out after the 2011 cold wave that included winterizing power plants. They could join the federal grid with the rest of us and have access to backup energy that perhaps would have assisted throughout this uncommon storm. The state could require that power plants have enough backup fuel. They can change building codes that require, state, more insulation for domestic and business pipes like they do up north. The legislature and the governor could do their job and more closely supervise the Electric Reliability Council of Texas (ERCOT), which runs the Texas-only power grid. Of course, this would cost customers more. It would also, possibly, require that the state give up a little of its energy self-reliance. I make sure that’s a bargain its residents are willing to strike right now. But none of this is going to get done if the folks running the state continue to make every earthly event an ideological showdown. Let’s evaluation: as soon as clients started losing power, Texas Governor Abbott appeared on Fox and positioned the blame on the devil itself: green energy. The wind turbines that froze during the storm. Never mind that wind was only supposed to represent 7 percent of the state’s winter season energy, according to The Texas Tribune Never ever mind that winterized wind turbines– yes, apparently that’s a showroom choice– handle to work in cold weather in Canada. (As MSNBC‘s Joe Scarborough tweeted: ” Texas Guv triggers Texas energy facilities rot under his watch, bringing unknown suffering to millions of Texans, and he blames … wait for it … AOC.”) Then there was this from previous U.S Energy Secretary and Texas Guv Rick Perry: “Texans would be without electricity for longer than three days to keep the federal government out of their company,” he was quoted as saying by the Houston Chronicle (Don’t take a survey on that one, Rick.) In any occasion, my betting is Texas, a great state, will conquer the buck-passing and resolve its problems. Big businesses moving into the state, like Oracle and HP, will have something to state about recent events. Will insurance companies, who are going to foot a multi-billion costs partly due to the fact that of state’s head-in-the-sand regulatory system. Perry, Abbott and the rest will maybe now learn it does not pay to get sidetracked by owning the libs 24/ 7.

Reuters

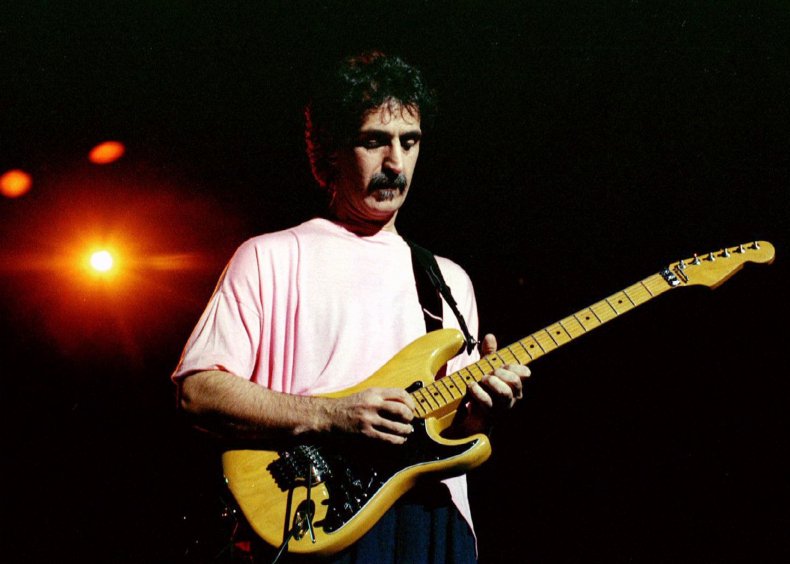

Loose Modification: The GameStop/Robinhood congressional hearings were held last week in Washington. I’m just sure about one thing after CEO Vlad Tenev’s statement: I’m not buying what Tenev was selling. To this day, he declares Robinhood wasn’t in the midst of a liquidity crisis when it stopped trading on GameStop, AMC and other fan favorites on Reddit Well, if you required more cash to continue doing business, what the heck is that? In any case, Robinhood has lost whatever track record it had as a safe space for private financiers. Unsure Tenev, or his investors, truly care– there will be a huge IPO at some point this year, I reckon. The whole rumpus is an excellent lesson for all of us. As previous FDIC manager Sheila Bair stated on CNBC just recently, there’s always a smarter person on the other end of the trade … Buffettville: If you have actually never seen the 97- year-old Charlie Munger in action at the Berkshire Hathaway yearly meetings, you can catch him live-streamed on Yahoo! Finance on February 24 th when he hosts the Daily Journal’s annual conference. The company, which he chairs, publishes papers, however primarily sells management software to courts and other justice-related entities … Buddies and Family: Have a look at the new self-help book by executive coach and On the Street factor Karen Warner: The Sudden Caregiver: A Roadmap for Resilient Caregiving. Karen tells the story of learning “out of the blue” that her other half, who was a good friend of mine by the method, was diagnosed with stage IV cancer– and how she “immediately” signed up with “a silent army of casual unsettled household caregivers around the globe who had also been pushed into abrupt service.” More here … Buddy # 2: David Fishof, the brain behind Ringo Starr & His All-Starr Band, has produced a new film about his Rock-and-roll Dream camps. Here’s the trailer … On the Street Jukebox: Got a note from master PR guy Andy Tannen after I wrote about former Deep Purple co-founder Ritchie Blackmore in last week’s column. Andy told me the story of attending a 1971 Frank Zappa performance in Montreux, Switzerland, which was interrupted by a fire that burned the casino to the ground. Andy got out in one piece. The occasion simply occurs to be the topic of the timeless Deep Purple struck “Smoke on the Water.” Listen to it here And thanks, Andy: you are part of rock and roll history! … Random fantastic song of the week: “ Deceptacon” by Jessica Hernandez and the Deltas … See you all next week and remain safe, Texas … and Oklahoma, Missouri and Tennessee.

No comments:

Post a Comment